2024 FAFSA Tax Year: Your Ultimate Guide To Navigating Financial Aid

Hey there, student or parent of a student! If you're stressing about paying for college and wondering how the 2024 FAFSA tax year works, you're in the right place. Filling out the Free Application for Federal Student Aid (FAFSA) can feel like solving a Rubik’s Cube while blindfolded, but don’t worry—we’ve got you covered. This guide will break down everything you need to know about the 2024 FAFSA tax year so you can maximize your financial aid opportunities.

Let’s face it, college ain’t cheap. Tuition fees, textbooks, dorms—it all adds up. That’s why understanding the 2024 FAFSA tax year is crucial if you want to secure the financial support you deserve. Whether you’re applying for grants, loans, or work-study programs, knowing which tax info to use can make or break your chances of getting the funds you need.

But hold up—before we dive into the nitty-gritty, let’s talk about why this matters. Financial aid isn’t just a nice-to-have; for many students, it’s a must-have. The 2024 FAFSA tax year is all about using the right financial data to show your eligibility. So, buckle up, grab your coffee, and let’s unravel the mystery of FAFSA together.

- Stream Kannada Movies Online Watch The Latest Greatest

- Kannada Cinema 2025 Trends Movierulz Ethical Viewing

What Exactly is the 2024 FAFSA Tax Year?

First things first, what’s the deal with the 2024 FAFSA tax year? Simply put, it refers to the tax year that you’ll use when filling out the FAFSA form for the upcoming academic year. For the 2024–2025 school year, you’ll need to provide your 2022 tax information. Why 2022? Because FAFSA uses prior-prior year (PPY) tax data to determine your financial aid eligibility.

Here’s the thing: using older tax data actually makes the process easier. You don’t have to scramble to file your taxes early or estimate your income. Instead, you can rely on verified data from two years ago. Sounds like a win, right?

Why Does Prior-Prior Year Matter?

The prior-prior year (PPY) rule is a game-changer for students and their families. Before this rule, you had to use the previous year’s tax info, which meant waiting until after tax season to complete your FAFSA. Now, with PPY, you can submit your FAFSA as soon as October 1st of the year before you plan to attend college.

- Kannada Movie Guide Best Of 2023 Safe Streaming Tips

- Unveiled The Most Erotic Movies Celebrity Picks You Need To See

This early submission window gives you a leg up in securing financial aid. Many schools award aid on a first-come, first-served basis, so getting your application in early can make a huge difference. Plus, using older tax data reduces the chances of errors or last-minute changes to your financial situation.

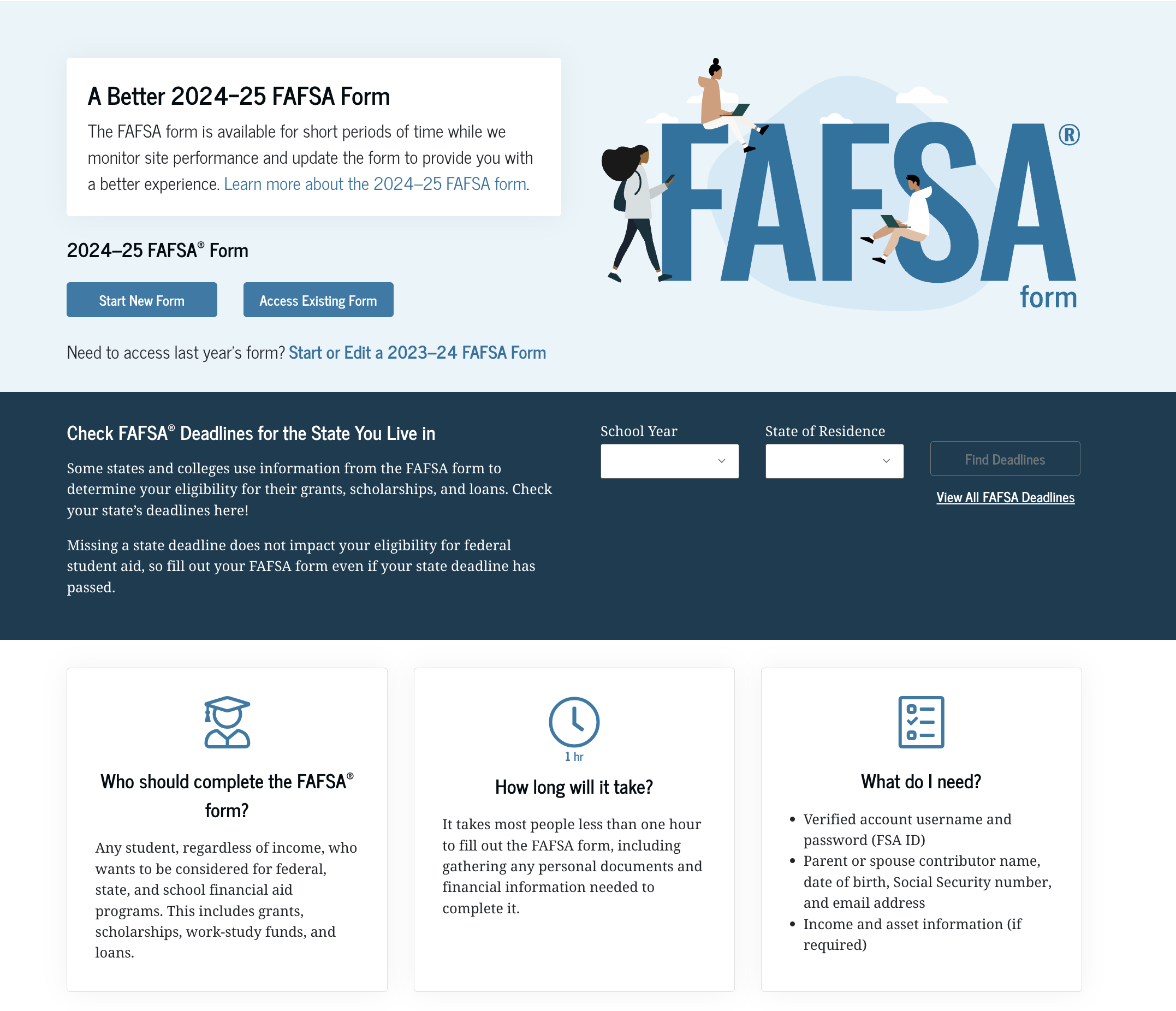

Understanding the 2024 FAFSA Deadlines

Now that you know which tax year to use, let’s talk deadlines. Missing the FAFSA deadline is like leaving your phone at home before a road trip—it’s just not smart. Here’s a quick rundown of the key dates you need to remember:

- Federal Deadline: June 30, 2024, for the 2024–2025 academic year.

- State Deadlines: Vary by state, so check your state’s specific requirements.

- College Deadlines: Some schools have earlier deadlines, so be sure to confirm with your institution.

Pro tip: Submit your FAFSA as soon as possible after October 1st. Not only does this increase your chances of getting aid, but it also gives you more time to address any issues that may arise during the process.

What Happens If You Miss the Deadline?

Missing the FAFSA deadline isn’t the end of the world, but it can limit your options. You might still qualify for federal loans, but you could miss out on grants, scholarships, and work-study opportunities. Plus, some states and schools won’t consider late applications for certain types of aid.

To avoid this headache, set reminders, mark your calendar, and stay organized. It’s like meal prepping for the week—doing it early saves you stress later on.

Gathering the Right Tax Documents

Alright, let’s talk about the paperwork. To complete the 2024 FAFSA, you’ll need to gather the following tax documents:

- Your 2022 federal tax returns (Form 1040).

- W-2 forms for 2022.

- Records of untaxed income, such as child support received or veterans’ benefits.

- Bank statements and investment records from 2022.

If you’re a dependent student, you’ll also need your parents’ tax info. This includes their 2022 federal tax returns, W-2 forms, and any other relevant financial documents.

Using the IRS Data Retrieval Tool

One of the easiest ways to transfer your tax info into the FAFSA is by using the IRS Data Retrieval Tool (DRT). This tool allows you to securely import your 2022 tax data directly from the IRS into your FAFSA form. It’s fast, accurate, and eliminates the need for manual entry.

However, there are some cases where you might not be able to use the DRT. For example, if you filed an amended return or if your marital status has changed, you’ll need to manually enter your tax info. Just remember, accuracy is key here. Double-check everything before hitting submit.

Who Qualifies for FAFSA?

Not everyone is eligible for FAFSA, but the good news is that most students are. To qualify, you must meet the following criteria:

- Be a U.S. citizen or eligible non-citizen.

- Have a valid Social Security number.

- Hold a high school diploma or GED.

- Be enrolled or accepted for enrollment in an eligible program.

- Maintain satisfactory academic progress.

- Not owe a refund on a federal student grant or be in default on a federal student loan.

If you meet these requirements, you’re good to go. But remember, FAFSA isn’t just for low-income students. Even if you think you won’t qualify for need-based aid, you should still apply. You might be eligible for other types of aid, like unsubsidized loans or work-study programs.

Special Circumstances That Affect Eligibility

Sometimes life throws curveballs that affect your financial situation. If you’ve experienced a significant change in income, family size, or other factors, you can appeal to your school’s financial aid office for a review. They might adjust your aid package based on your unique circumstances.

For example, if you lost your job or had unexpected medical expenses in 2022, you can provide documentation to support your case. Just be prepared to explain the situation clearly and concisely.

How is Your Expected Family Contribution (EFC) Calculated?

Your Expected Family Contribution (EFC) is the amount your family is expected to contribute toward your education. It’s calculated based on your tax info, income, assets, and family size. Here’s how it works:

The FAFSA formula considers your family’s taxed and untaxed income, assets, and benefits. It also takes into account the number of people in your household and how many family members will be attending college during the academic year.

Keep in mind that your EFC isn’t necessarily the amount you’ll have to pay. It’s just a starting point for determining your financial need. Some schools may offer aid packages that exceed your EFC, depending on their resources and policies.

What if Your EFC is Too High?

If your EFC is higher than expected, don’t panic. There are still ways to reduce your out-of-pocket costs. Look into scholarships, grants, and private loans. Many organizations offer merit-based aid that isn’t tied to your financial need.

Also, consider negotiating with your school’s financial aid office. If you have a compelling reason why your EFC doesn’t reflect your true financial situation, they might be willing to adjust your aid package.

Maximizing Your Financial Aid Opportunities

Now that you know the basics, let’s talk about how to maximize your financial aid. Here are a few tips to help you get the most out of the 2024 FAFSA tax year:

- Apply early. As we mentioned earlier, submitting your FAFSA early increases your chances of getting aid.

- Use the IRS Data Retrieval Tool. It’s faster and more accurate than manual entry.

- Explore scholarships. There are tons of scholarships available for students with different backgrounds, talents, and interests.

- Consider work-study programs. These programs allow you to earn money while gaining valuable work experience.

- Appeal for more aid if necessary. If your financial situation changes, don’t hesitate to reach out to your school’s financial aid office.

Remember, every little bit helps. Even if you only qualify for a small grant or loan, it can make a big difference in your overall college costs.

Common Mistakes to Avoid

Before we wrap up, let’s go over some common FAFSA mistakes to avoid:

- Missing deadlines. Submit your FAFSA as soon as possible to avoid missing out on aid.

- Providing incorrect tax info. Double-check your numbers to ensure accuracy.

- Not appealing for more aid. If your financial situation changes, don’t be afraid to ask for a review.

- Ignoring scholarships. There’s free money out there—go get it!

By avoiding these pitfalls, you’ll increase your chances of securing the financial aid you need to succeed in college.

Conclusion: Take Control of Your Financial Future

And there you have it—everything you need to know about the 2024 FAFSA tax year. From understanding which tax info to use to maximizing your financial aid opportunities, this guide has got you covered. Remember, filling out the FAFSA is one of the most important steps you can take toward paying for college.

So, what’s next? Start gathering your tax documents, set those deadlines, and get ready to submit your FAFSA. And don’t forget to share this article with anyone who could benefit from it. Together, we can make college more accessible for everyone.

Got questions or comments? Drop them below. We’d love to hear from you!

Table of Contents

- What Exactly is the 2024 FAFSA Tax Year?

- Why Does Prior-Prior Year Matter?

- Understanding the 2024 FAFSA Deadlines

- What Happens If You Miss the Deadline?

- Gathering the Right Tax Documents

- Using the IRS Data Retrieval Tool

- Who Qualifies for FAFSA?

- Special Circumstances That Affect Eligibility

- How is Your Expected Family Contribution (EFC) Calculated?

- What if Your EFC is Too High?

- Maximizing Your Financial Aid Opportunities

- Common Mistakes to Avoid

Article Recommendations

- Noelle Leyva Onlyfans Leak The Truth Controversy And Aftermath

- Kannada Movies 2023 Watch Legally Avoid Movierulz Risks

Detail Author:

- Name : Eleonore Metz

- Username : calista85

- Email : cremin.michelle@gutmann.com

- Birthdate : 1997-02-25

- Address : 7740 Harmon Causeway Suite 280 Auerburgh, KY 52617-0143

- Phone : +1 (440) 693-3823

- Company : Schuppe, Murray and Corwin

- Job : Conveyor Operator

- Bio : Harum in voluptatum et nobis reprehenderit. Qui quo corrupti fugit velit. Et delectus facilis qui quas voluptas molestias nihil. Ut vel excepturi velit voluptatem.

Socials

instagram:

- url : https://instagram.com/shields1992

- username : shields1992

- bio : Quam culpa delectus eum quia. Quia eligendi doloremque qui voluptatibus. Rerum unde quo ipsum.

- followers : 3605

- following : 1706

linkedin:

- url : https://linkedin.com/in/shields1982

- username : shields1982

- bio : Quidem et explicabo veritatis dignissimos.

- followers : 6247

- following : 1827

tiktok:

- url : https://tiktok.com/@alison.shields

- username : alison.shields

- bio : Esse quaerat odio reiciendis quam blanditiis.

- followers : 2540

- following : 2174

twitter:

- url : https://twitter.com/ashields

- username : ashields

- bio : Saepe minima nemo dignissimos ut. Minima fuga qui numquam fugit ut architecto. Eaque maxime nam quos qui laboriosam.

- followers : 6992

- following : 722