What Does The Billing Address Mean? Unlock The Mystery Behind This Essential Detail

So, you’ve probably come across the term “billing address” countless times while shopping online, setting up subscriptions, or even signing up for services. But what does the billing address mean, exactly? Is it just another form field you need to fill out, or does it hold more significance than you think? Let’s dive into the world of billing addresses and uncover what they’re all about. You’re about to learn something that might change how you view online transactions forever.

Picture this: You’re at the checkout page of an online store, ready to hit that “Place Order” button. Suddenly, you’re asked for your billing address. Ever wondered why it’s required? It’s not just some random detail; it’s a crucial piece of information that plays a big role in ensuring your transactions are secure and legitimate. Stick with me, and I’ll break it all down for you.

In today’s digital age, understanding terms like billing address is more important than ever. Whether you’re shopping online, paying bills, or setting up automatic payments, knowing what the billing address means can save you from potential headaches. Let’s get started and make sense of this often-overlooked detail.

- Kannada Movies 2025 Find Legal Streaming Options No Movierulz

- Stream Kannada Movies Online Watch The Latest Greatest

Understanding the Basics: What Is a Billing Address?

Alright, let’s start with the basics. A billing address is simply the address associated with your payment method. It’s where your bank or credit card company sends your statements and bills. But it’s more than just a place where mail gets delivered. This address serves as a verification tool to ensure that the person making the transaction is the rightful owner of the payment method being used.

Why Do Businesses Ask for Billing Addresses?

Here’s the deal: businesses aren’t just being nosy when they ask for your billing address. They’re actually trying to protect both you and them from fraudulent activities. By matching the billing address you provide with the one on file with your bank or credit card issuer, they can confirm that you’re the legitimate account holder. Think of it as a digital handshake that says, “Hey, this is really you!”

- Verification: Ensures the transaction is legitimate.

- Security: Helps prevent fraud by matching addresses.

- Convenience: Allows businesses to send invoices or receipts to the right place.

The Role of Billing Address in Online Transactions

When it comes to online shopping, the billing address plays a key role in the checkout process. It’s not just about filling out a form; it’s about ensuring that your payment is processed securely. Many online platforms use the billing address to verify your identity before completing the transaction. This extra layer of security is especially important in today’s world, where cybercrime is on the rise.

- Kranti 2023 Watch Kannada Movie Online Free The Truth

- Free Movie Downloads Filmywap 300mb Hub Legal Options

How Billing Addresses Prevent Fraud

Imagine this scenario: Someone steals your credit card number and tries to use it to make a purchase. If the billing address they provide doesn’t match the one on file with your bank, the transaction will likely be flagged and stopped. This simple yet effective measure helps protect you from unauthorized charges and keeps your financial information safe.

Is the Billing Address Always the Same as the Shipping Address?

Not necessarily! While many people use the same address for both billing and shipping, that’s not always the case. For example, you might live in one city but have your bills sent to a family member in another city. Or maybe you’re buying a gift and want it shipped directly to the recipient. In these situations, the billing address and shipping address will differ.

When Do You Use a Different Billing Address?

There are plenty of valid reasons why someone might use a different billing address. Here are a few common examples:

- If you’re traveling and want your bills sent to a temporary address.

- If you’re purchasing something for someone else and want it shipped directly to them.

- If you have a PO box for receiving mail but live at a different address.

What Happens If the Billing Address Is Incorrect?

Let’s say you accidentally enter the wrong billing address while making a purchase. Depending on the platform, this could cause issues with your transaction. Some systems will automatically flag the purchase as suspicious if the billing address doesn’t match the one on file with your bank. In extreme cases, the transaction might even be canceled altogether.

How to Avoid Billing Address Errors

Here are a few tips to help you avoid billing address mistakes:

- Double-check the address before submitting your order.

- Use autofill features if your browser supports them, but verify the details are correct.

- Keep your billing address up to date with your bank or credit card issuer.

How to Update Your Billing Address

Life happens, and sometimes your billing address needs to change. Whether you’ve moved to a new home or switched to a different billing method, updating your billing address is a straightforward process. Most banks and credit card companies allow you to update your address online or by contacting their customer service team.

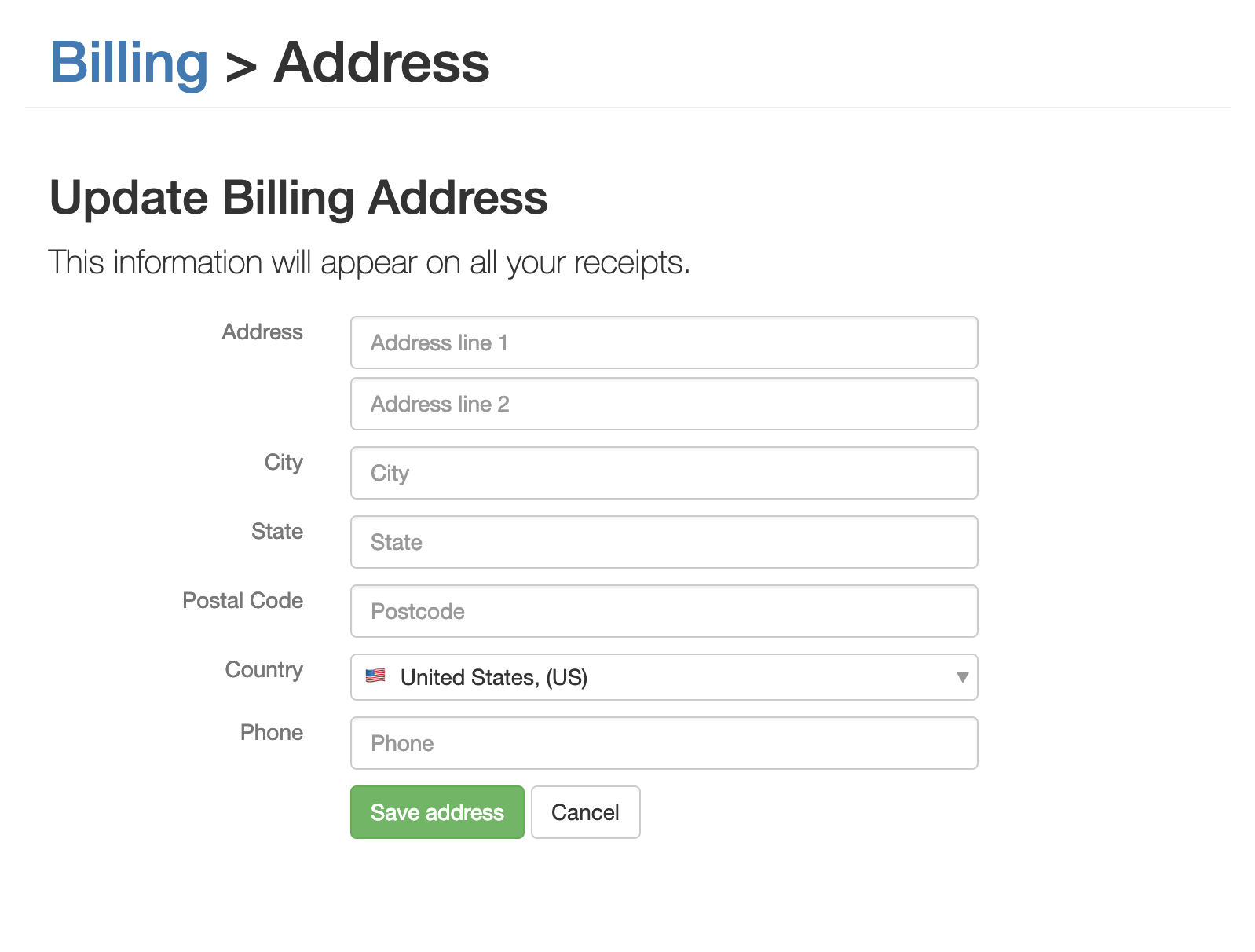

Steps to Update Your Billing Address

Here’s a quick guide on how to update your billing address:

- Log in to your bank or credit card account online.

- Look for the “Account Settings” or “Profile” section.

- Find the option to update your address.

- Enter your new billing address and save the changes.

Common Misconceptions About Billing Addresses

There are a few myths floating around about billing addresses that can lead to confusion. Let’s clear them up once and for all.

Myth #1: The Billing Address Must Be Where You Live

This isn’t true! As we’ve already discussed, your billing address can be different from your residential address. It’s simply the address associated with your payment method, and it doesn’t have to match where you physically live.

Myth #2: You Can Use Any Address for Billing

Not so fast! While you can technically enter any address during checkout, using a fake or incorrect billing address could lead to your transaction being declined. Stick with the address on file with your bank to avoid any issues.

Security Tips for Protecting Your Billing Address

Now that you know how important the billing address is, let’s talk about how to keep it secure. Here are a few tips to help protect your billing address and prevent unauthorized access:

- Never share your billing address with untrusted websites or individuals.

- Use strong, unique passwords for your online accounts.

- Enable two-factor authentication whenever possible.

How to Spot Potential Fraud

Be on the lookout for red flags that could indicate fraud. If you notice any unfamiliar charges on your account or receive notifications about transactions you didn’t make, contact your bank immediately. Staying vigilant is key to protecting your financial information.

Conclusion: Why Understanding Billing Addresses Matters

And there you have it! You now know what the billing address means and why it’s such an important part of online transactions. By understanding its role in verifying your identity and preventing fraud, you can make smarter, safer choices when shopping online or managing your finances.

So, what’s next? Take a moment to review your billing address and ensure it’s up to date with your bank or credit card issuer. And remember, if you ever have questions or concerns about your billing address, don’t hesitate to reach out to customer support. Your financial security is worth the effort!

Got any thoughts or questions about billing addresses? Drop a comment below and let’s chat. And while you’re at it, why not share this article with your friends? Who knows? You might just help someone avoid a billing address headache!

Table of Contents

- Understanding the Basics: What Is a Billing Address?

- The Role of Billing Address in Online Transactions

- Is the Billing Address Always the Same as the Shipping Address?

- What Happens If the Billing Address Is Incorrect?

- How to Update Your Billing Address

- Common Misconceptions About Billing Addresses

- Security Tips for Protecting Your Billing Address

- Conclusion: Why Understanding Billing Addresses Matters

Article Recommendations

- Kannada Movies 2025 5movierulz More Find Your Next Watch

- Stream Smarter Find Movies Online With Justwatch More

Detail Author:

- Name : Noemy Konopelski

- Username : gkilback

- Email : waters.sid@yahoo.com

- Birthdate : 2005-07-21

- Address : 962 Considine Point Apt. 847 Lake Grant, CA 58865-3809

- Phone : 239.364.9587

- Company : Jast-Hagenes

- Job : Streetcar Operator

- Bio : Fuga alias sed rerum qui eligendi voluptate. Ea asperiores atque tempora sunt nam odit. Ratione consequuntur praesentium totam est. Minus deserunt reprehenderit sed nihil vero.

Socials

facebook:

- url : https://facebook.com/hand2000

- username : hand2000

- bio : Asperiores eveniet exercitationem quisquam voluptate.

- followers : 5236

- following : 1852

instagram:

- url : https://instagram.com/brandohand

- username : brandohand

- bio : Ratione nisi cum exercitationem distinctio aperiam. Quia et error debitis quis.

- followers : 4236

- following : 2145

tiktok:

- url : https://tiktok.com/@brando.hand

- username : brando.hand

- bio : In illum eius libero id illo.

- followers : 1740

- following : 1260