Dallas TX Property Tax: A Comprehensive Guide For Homeowners

Property tax in Dallas TX can feel like a maze, but don’t stress! If you own a home or are planning to buy one in this vibrant city, understanding how property taxes work is crucial. It’s not just about paying bills; it’s about knowing your rights and responsibilities as a property owner. Dallas has its own set of rules and regulations, so let’s break it down together so you’re fully equipped to navigate the system.

When you hear “property tax,” your mind might immediately jump to dollar signs and headaches. But hey, it’s not all bad! Property taxes fund essential services that keep our communities running smoothly, from schools to infrastructure. In Dallas TX, the system is designed to ensure fairness, but sometimes it can get a little tricky. That’s why we’re here—to simplify everything for you.

This guide will walk you through the ins and outs of property taxes in Dallas TX. From how they’re calculated to available exemptions, we’ve got all the details covered. So grab a coffee, sit back, and let’s dive into the world of property taxation in one of America’s fastest-growing cities!

- Andraya Carters Wife The Untold Story Of Bre Austin

- Kannada Movies Online Watch The Latest Best 20222025

Table of Contents

- What is Property Tax?

- The Dallas TX Property Tax System

- How Property Taxes Are Calculated

- Taxing Authorities in Dallas TX

- Payment Options for Property Taxes

- Exemptions and Discounts

- Appealing Your Property Tax

- Important Dates to Remember

- How Property Taxes Fund Public Services

- Tips for Dallas TX Homeowners

What is Property Tax?

Alright, let’s start with the basics. Property tax is essentially a levy placed on real estate properties by local governments. In Dallas TX, these taxes are used to fund various public services such as schools, roads, emergency services, and more. Think of it as your contribution to making the city a better place for everyone.

But here’s the thing—property taxes aren’t just a flat fee. They’re calculated based on the assessed value of your property, which means bigger homes or more valuable properties generally pay higher taxes. It’s a system designed to distribute the financial burden fairly among property owners.

Now, before we move on, let’s clear up one common misconception. Property tax isn’t optional. If you own a home, you’re required to pay it. But don’t worry; there are ways to manage it effectively, and we’ll cover those later in this article.

- Vegamovies More Streaming Guide Errors Alternatives

- Rosaline Dawnx Leaks Unveiling The Truth Behind The Hype Now

The Dallas TX Property Tax System

Dallas TX has a well-structured property tax system, but it can still feel overwhelming if you’re not familiar with the terminology. Here’s a quick rundown:

Key Players in the System

- Appraisal District: This is the entity responsible for determining the value of your property. In Dallas, it’s called the Dallas Central Appraisal District (DCAD).

- Taxing Authorities: These include local governments like the city of Dallas, school districts, and special districts that set tax rates.

- Tax Collector: The entity responsible for collecting property taxes from homeowners.

The process works like this: the appraisal district assesses your property’s value, the taxing authorities set the tax rates, and the tax collector ensures you pay up. Sounds simple, right? Well, there are a few nuances we’ll explore next.

How Property Taxes Are Calculated

Let’s get into the nitty-gritty of how property taxes are calculated in Dallas TX. It’s actually a pretty straightforward formula, but understanding the components will help you grasp the overall picture.

Here’s the basic equation:

Property Tax = Assessed Value × Tax Rate

Let’s break it down:

- Assessed Value: This is the value assigned to your property by the appraisal district. It’s usually a percentage of the market value.

- Tax Rate: This is the rate set by the taxing authorities. It’s expressed as a percentage or dollars per $100 of assessed value.

For example, if your property’s assessed value is $250,000 and the tax rate is 2%, your property tax would be $5,000. Simple, right? But remember, this is just an example. Rates can vary depending on your location within Dallas TX.

Taxing Authorities in Dallas TX

Now, let’s talk about who’s calling the shots when it comes to property taxes in Dallas TX. The taxing authorities play a crucial role in determining how much you’ll pay.

Main Taxing Authorities

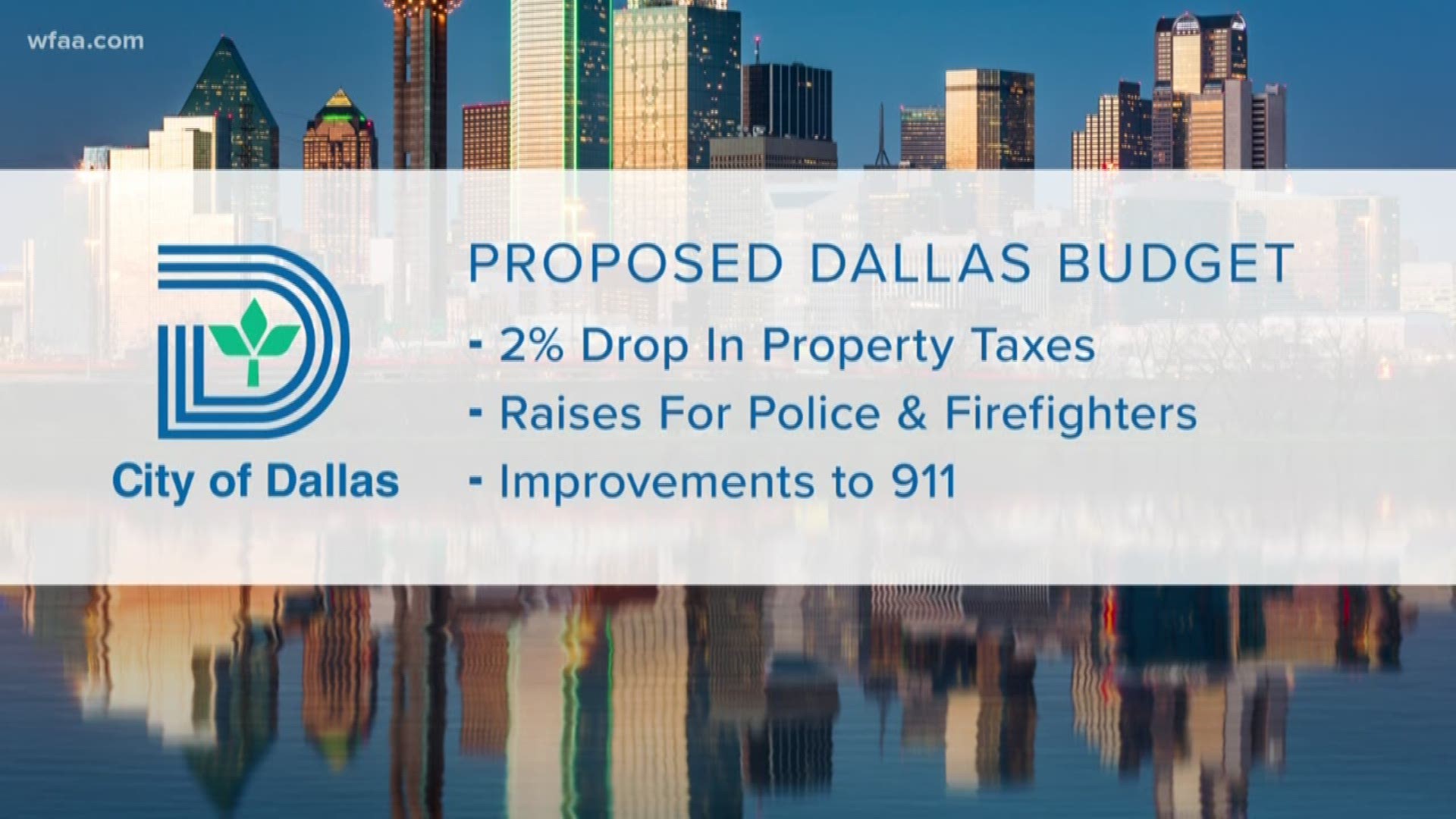

- Dallas Independent School District (DISD): This is the largest taxing authority in the city. They use property taxes to fund public education.

- City of Dallas: The city collects property taxes to maintain infrastructure, public safety, and other municipal services.

- Special Districts: These could include water districts, hospital districts, or other entities that provide specific services.

Each authority sets its own tax rate, which is then combined to give you the total property tax bill. It’s important to note that these rates can change annually, so it’s always a good idea to stay informed.

Payment Options for Property Taxes

Alright, let’s talk about the practical side—how do you actually pay your property taxes in Dallas TX? There are several options available to make the process easier for homeowners.

Payment Methods

- Online Payments: Most homeowners prefer paying their taxes online through the official portal. It’s convenient and secure.

- Mail-In Payments: If you’re old-school, you can still send in a check. Just make sure to include all the necessary information and send it well in advance of the deadline.

- In-Person Payments: Some people like the face-to-face interaction. You can visit the tax office and pay in person, though this option might involve a bit of waiting.

One important tip: if you’re paying through a mortgage lender, they might handle the tax payments for you as part of your escrow account. Double-check with your lender to ensure everything’s covered.

Exemptions and Discounts

Now for the good news—there are exemptions and discounts available that could lower your property tax bill. Let’s explore some of the most common ones in Dallas TX.

Types of Exemptions

- Homestead Exemption: If your property is your primary residence, you may qualify for a homestead exemption, which reduces your taxable value.

- Over 65/Disabled Exemptions: Seniors and disabled homeowners can benefit from additional exemptions that further reduce their tax burden.

- Energy-Efficient Improvements: If you’ve made energy-efficient upgrades to your home, you might qualify for a reduction in property taxes.

Applying for these exemptions usually requires filling out some paperwork, but it’s definitely worth the effort if it means saving money.

Appealing Your Property Tax

What happens if you believe your property tax bill is too high? You have the right to appeal! Here’s how the process works in Dallas TX.

First, you’ll need to gather evidence to support your case. This could include recent property appraisals, comparable sales data, or other relevant information. Once you’ve prepared your materials, you can file an appeal with the appraisal review board.

Keep in mind that the appeals process can take time, so patience is key. But if you have a strong case, it could result in a lower tax bill, so it’s definitely worth pursuing if you believe the assessed value is inaccurate.

Important Dates to Remember

Staying on top of important dates is crucial when it comes to property taxes in Dallas TX. Here are some key deadlines to keep in mind:

- January 1: The official date for property tax assessment. Your property’s value is determined as of this date.

- October: Tax bills are typically sent out around this time.

- January 31: The deadline for paying your property taxes without incurring penalties.

Missing these deadlines can result in late fees and penalties, so mark your calendar and set reminders if necessary.

How Property Taxes Fund Public Services

Property taxes in Dallas TX play a vital role in funding essential public services. Here’s a breakdown of where your money goes:

- Education: A significant portion of property taxes goes toward funding public schools. This includes teacher salaries, classroom materials, and school facilities.

- Infrastructure: Property taxes help maintain roads, bridges, and other infrastructure that keeps the city running smoothly.

- Public Safety: Your tax dollars also support police and fire departments, ensuring the safety and security of all residents.

Understanding how your property taxes are used can give you a greater appreciation for the contributions you make to your community.

Tips for Dallas TX Homeowners

Finally, here are some practical tips for homeowners in Dallas TX looking to manage their property taxes effectively:

- Stay Informed: Keep up with changes in tax rates and regulations. Sign up for updates from the appraisal district or city government.

- Take Advantage of Exemptions: Make sure you’re claiming all the exemptions you’re eligible for. It could mean significant savings.

- Review Your Bill Carefully: Double-check your property tax bill for any errors. Mistakes happen, and catching them early can save you a lot of hassle.

By following these tips, you’ll be well-prepared to handle property taxes in Dallas TX and ensure you’re getting the most value for your money.

Conclusion

In conclusion, property taxes in Dallas TX might seem daunting at first, but with the right knowledge and resources, they’re manageable. From understanding how they’re calculated to taking advantage of available exemptions, this guide has provided you with all the tools you need to navigate the system.

Remember, property taxes are more than just a financial obligation—they’re an investment in your community. By paying your taxes on time and staying informed, you’re contributing to the growth and prosperity of Dallas TX.

So, what’s next? Take action! Review your property tax bill, explore available exemptions, and don’t hesitate to reach out to the appraisal district if you have questions. And if you found this article helpful, be sure to share it with fellow homeowners or leave a comment below. Together, we can make property taxes a little less stressful for everyone!

Article Recommendations

- Unveiled The Most Erotic Movies Celebrity Picks You Need To See

- Kannada Movies 2024 Streaming 4movierulz Whats New

Detail Author:

- Name : Mr. Dusty Mitchell II

- Username : graham.harmon

- Email : everette90@lockman.net

- Birthdate : 1985-11-08

- Address : 298 Rosie Shore Apt. 825 McLaughlinhaven, TN 09341-5496

- Phone : 423.304.7905

- Company : Schroeder LLC

- Job : Food Scientists and Technologist

- Bio : Molestiae est quod quo consequuntur. Natus veritatis sit non voluptas. Et sed neque architecto quibusdam non adipisci pariatur vero. Sunt pariatur molestias quos qui cumque.

Socials

instagram:

- url : https://instagram.com/parkerbalistreri

- username : parkerbalistreri

- bio : Dolores accusamus et iste sequi. Nulla cupiditate saepe deleniti qui.

- followers : 739

- following : 1110

twitter:

- url : https://twitter.com/parker_balistreri

- username : parker_balistreri

- bio : Voluptatem deserunt optio eveniet impedit repellat doloribus. Eligendi autem sed alias eius. Aut facilis accusantium id delectus.

- followers : 2282

- following : 2681