Progressive Auto Insurance Cancellation: The Ultimate Guide To Understanding Your Options

Let’s face it, life happens. Sometimes, you need to cancel your Progressive auto insurance policy for whatever reason. It could be because you’ve sold your car, moved to a new place, or simply found a better deal elsewhere. Whatever the case may be, understanding the ins and outs of Progressive auto insurance cancellation is crucial to avoid unnecessary fees or headaches.

Now, I get it – insurance can feel like a maze of terms, clauses, and fine print. But don’t worry, because we’ve got you covered. In this guide, we’ll break down everything you need to know about Progressive auto insurance cancellation in a way that’s easy to understand. Whether you’re just curious or ready to take action, this article has got your back.

Before we dive into the nitty-gritty, let’s address the elephant in the room: why are you here? If you’re thinking about canceling your Progressive policy, you’re not alone. Thousands of drivers do it every year. The key is to do it the right way, ensuring you don’t end up with any surprises down the road. So, buckle up (pun intended), and let’s get started!

- What Is Movierulz Is Movierulz Safe All You Need To Know

- Kannada Movies 2023 Watch Legally Avoid Movierulz Risks

Why Cancel Progressive Auto Insurance?

First things first, why would anyone want to cancel their Progressive auto insurance policy? Well, there are plenty of reasons, and they’re all valid. Some people sell their cars, while others switch to a different provider for better rates or coverage. Let’s take a look at some of the most common reasons:

- Sold or gifted your car

- Moved to a new location with different insurance requirements

- Found a better deal with another insurance provider

- No longer need car insurance (maybe you’re switching to public transportation)

- Financial constraints – sometimes, the cost just doesn’t fit the budget

Whatever your reason, Progressive understands that life changes, and they’ve made the cancellation process relatively straightforward. But before you hit the cancel button, make sure you’ve explored all your options. Maybe there’s a way to adjust your policy instead of canceling it altogether.

How to Cancel Progressive Auto Insurance

Alright, so you’ve made up your mind. It’s time to say goodbye to Progressive. But how do you go about canceling your policy? Let me walk you through the steps:

- Movierulz Latest Kannada Movie Updates Streaming Legal Concerns

- Free Adult Web Series Movies Find Hot Content Now

Step 1: Review Your Policy

Before you cancel, take a moment to review your policy details. Look for any cancellation fees or penalties that might apply. You don’t want to be hit with unexpected charges. Progressive is pretty transparent about these things, but it’s always good to double-check.

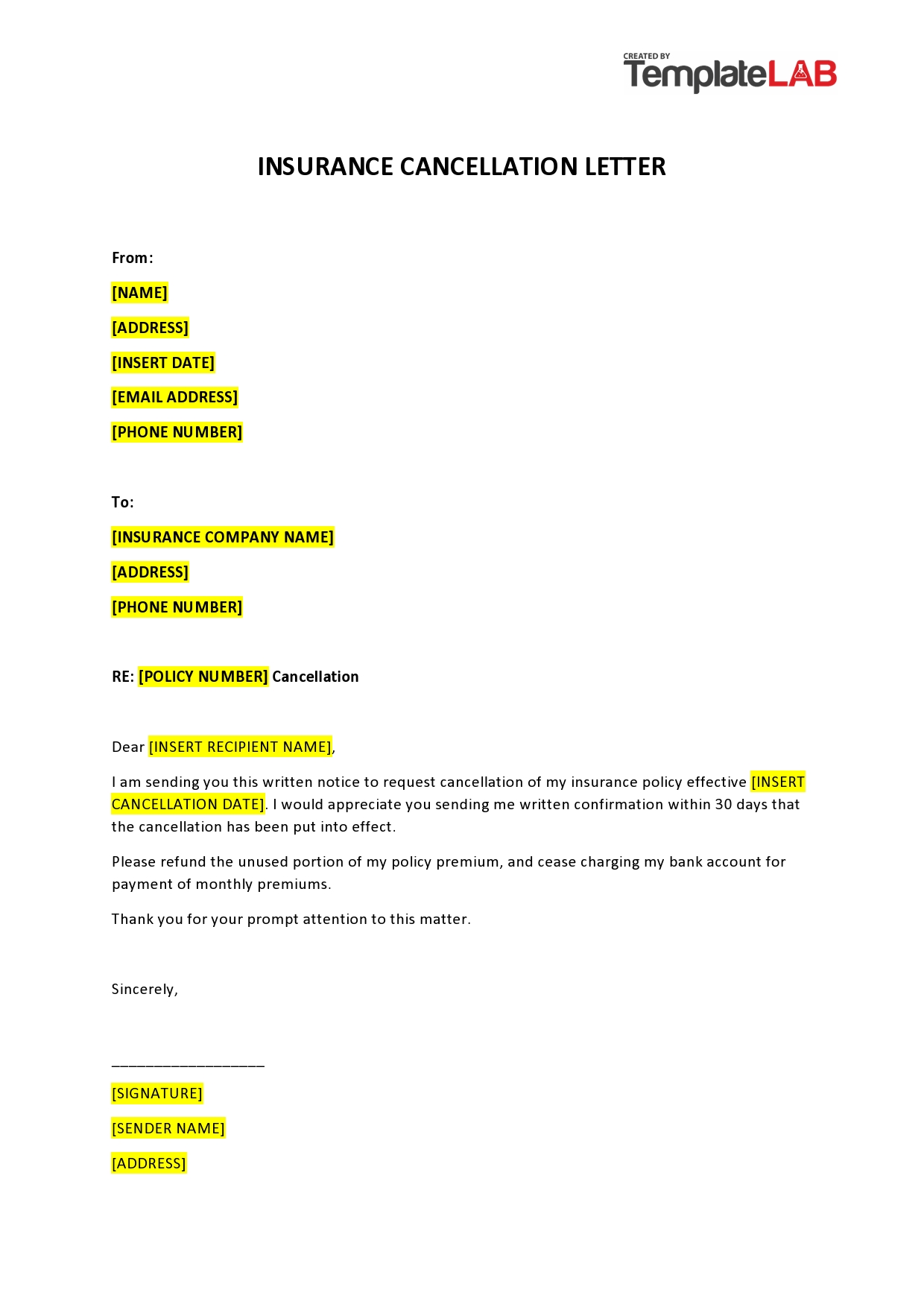

Step 2: Contact Progressive

Once you’ve reviewed your policy, it’s time to reach out to Progressive. You can do this in one of three ways:

- Call their customer service hotline

- Visit a local Progressive agent

- Log into your online account and submit a cancellation request

Each method has its pros and cons. If you prefer a human touch, calling or visiting an agent might be the way to go. If you’re all about convenience, the online option is quick and easy.

What Happens After You Cancel?

So, you’ve successfully canceled your Progressive auto insurance policy. Great! But what happens next? Here’s what you can expect:

First, Progressive will send you a cancellation confirmation. This document is important, so make sure you keep it for your records. It will outline the effective date of the cancellation and any outstanding balances you might owe.

Second, if you’ve prepaid your policy, Progressive will issue a refund for the unused portion. The refund process can take a few weeks, so be patient. And remember, if you have any questions, Progressive’s customer service team is just a phone call away.

Common Questions About Progressive Auto Insurance Cancellation

Let’s address some of the most frequently asked questions about canceling Progressive auto insurance:

Q: Can I cancel Progressive auto insurance online?

Absolutely! Just log into your account, navigate to the cancellation section, and follow the prompts. Easy peasy.

Q: Is there a cancellation fee?

It depends on your specific policy. Some policies come with early termination fees, while others don’t. Always check your policy documents for details.

Q: How long does it take to process a cancellation?

Progressive aims to process cancellations within a few business days. You’ll receive a confirmation email once the process is complete.

Q: What happens to my premium payments?

If you’ve prepaid your policy, Progressive will refund the unused portion. The exact timeline for refunds can vary, but it usually takes a couple of weeks.

Alternatives to Cancellation

Before you cancel your Progressive policy, consider these alternatives:

- Policy Adjustment: Maybe you don’t need to cancel entirely. You could adjust your coverage to better fit your needs and budget.

- Discounts: Progressive offers a variety of discounts that could lower your premium. Check if you’re eligible for any.

- Payment Plans: If cost is the issue, Progressive offers flexible payment plans that might help.

Sometimes, a little tweaking can make all the difference. Plus, keeping your policy intact means you won’t have to deal with the hassle of finding a new provider.

Progressive Auto Insurance Cancellation Fees: What You Need to Know

Let’s talk about the elephant in the room – cancellation fees. While Progressive doesn’t charge a cancellation fee for most policies, there are exceptions. For example, if you’re canceling a bundled policy or a policy with special terms, you might incur a fee.

Here’s the good news: Progressive is upfront about these fees. You’ll find all the details in your policy documents. If you’re unsure, don’t hesitate to reach out to their customer service team for clarification.

Tips for a Smooth Progressive Auto Insurance Cancellation

Want to make the cancellation process as smooth as possible? Here are a few tips:

- Keep all communication records – emails, call logs, and confirmations – in case you need them later.

- Double-check the cancellation date to ensure there’s no overlap with your new policy (if applicable).

- Follow up on your refund if you’ve prepaid your policy.

By staying organized and proactive, you can avoid any potential headaches down the road.

Progressive Auto Insurance Cancellation: The Legal Side

Now, let’s talk about the legal stuff. When you cancel your Progressive policy, you’re essentially terminating a contract. This means you need to comply with all the terms and conditions outlined in your policy.

For example, if you cancel mid-term, you might be required to pay any outstanding premiums. And if you’re financing your car, your lender might have specific requirements regarding insurance coverage.

It’s always a good idea to consult with a legal expert if you’re unsure about any aspect of the cancellation process. Better safe than sorry, right?

What to Do After Canceling Progressive Auto Insurance

So, you’ve canceled your Progressive policy. Now what? Here’s what you should do next:

Step 1: Secure New Coverage

If you’re switching to a new provider, make sure you have your new policy in place before your Progressive coverage ends. You don’t want to be uninsured, even for a day.

Step 2: Update Your Records

Notify your DMV, lender, and anyone else who needs to know about the change in your insurance status. This ensures everything stays in order.

Step 3: Reflect on Your Decision

Take a moment to reflect on why you canceled your Progressive policy. Was it the cost? The coverage? Or something else? This reflection can help you make better decisions in the future.

Final Thoughts: Progressive Auto Insurance Cancellation Made Simple

And there you have it – the ultimate guide to Progressive auto insurance cancellation. Whether you’re canceling due to life changes or better offers, the process doesn’t have to be stressful. By following the steps outlined in this article, you can ensure a smooth and hassle-free experience.

Before I wrap up, let me leave you with a final tip: always keep an open mind. Sometimes, what seems like a good idea at first might not be the best choice in the long run. So, explore all your options, weigh the pros and cons, and make the decision that’s right for you.

Now, it’s your turn. Have you canceled a Progressive policy before? What was your experience like? Share your thoughts in the comments below, and don’t forget to share this article with anyone who might find it helpful. Until next time, stay safe out there!

Table of Contents

- Why Cancel Progressive Auto Insurance?

- How to Cancel Progressive Auto Insurance

- What Happens After You Cancel?

- Common Questions About Progressive Auto Insurance Cancellation

- Alternatives to Cancellation

- Progressive Auto Insurance Cancellation Fees: What You Need to Know

- Tips for a Smooth Progressive Auto Insurance Cancellation

- Progressive Auto Insurance Cancellation: The Legal Side

- What to Do After Canceling Progressive Auto Insurance

- Final Thoughts: Progressive Auto Insurance Cancellation Made Simple

Article Recommendations

- Latest Telugu Movies Reviews Streaming News Yearly Guide

- Vegas Movies Guide From Classics To Zombie Heists Beyond

![How To Cancel Progressive Car Insurance In 2023 [Full Process]](https://www.mountshine.com/wp-content/uploads/2023/01/how-to-cancel-car-insurance-progressive.jpg)

Detail Author:

- Name : Eugene Barrows

- Username : ibrahim.beer

- Email : amalia.dach@rempel.com

- Birthdate : 1989-06-23

- Address : 128 Lynch Park North Ofeliashire, UT 50785

- Phone : +1-331-648-4396

- Company : Baumbach Inc

- Job : Fitter

- Bio : Pariatur id sint ipsum beatae corporis sint velit. Totam voluptas ipsa possimus id asperiores. Beatae iste aut dicta debitis facilis fugiat.

Socials

linkedin:

- url : https://linkedin.com/in/tyler180

- username : tyler180

- bio : Ipsa eum nulla enim earum cumque.

- followers : 594

- following : 752

instagram:

- url : https://instagram.com/dooleyt

- username : dooleyt

- bio : Eligendi et et corporis ut non rem. Omnis quis atque ullam. Qui possimus repellat velit.

- followers : 888

- following : 1123

twitter:

- url : https://twitter.com/tyler6751

- username : tyler6751

- bio : Qui voluptatem qui exercitationem qui. Aut quo id itaque eveniet. Eum repellendus enim quos dolor modi iusto. Eaque dignissimos occaecati quia beatae aliquid.

- followers : 1193

- following : 2557

tiktok:

- url : https://tiktok.com/@tdooley

- username : tdooley

- bio : Qui odit sint placeat repudiandae nihil totam totam nobis.

- followers : 4730

- following : 708